Humanoid Robot 2026 A humanoid robot in 2026 represents a fascinating point in robotics, sitting between rapid prototyping and the cusp of real-world application. Here’s a breakdown of what to expect, focusing on key players, technological trends, and potential applications.

State of the Art (Circa 2026 Forecast)

The field is moving from impressive lab demos to tackling the hard problems of reliability, cost, and real-world utility. 2026 will be a year of intensified competition and crucial testing.

Leading Players & Their 2026 Focus:

- Tesla – Optimus: By 2026, Tesla aims to have early commercial and industrial units deployed. The focus will be on cost reduction (the sub-$20,000 goal), improving reliability for simple factory tasks (like moving parts between stations), and proving its AI-powered “end-to-end neural net” for locomotion and manipulation in unstructured environments.

- Boston Dynamics – Atlas: While not commercially sold, Atlas in 2026 will continue to be the high-performance research platform. Expect even more stunning displays of dynamic mobility (parkour, complex acrobatics), advanced manipulation (using tools, handling delicate objects), and recovery from disturbances. It sets the bar for physical capability.

- Figure AI: Having secured massive funding and a partnership with OpenAI (for AI) and BMW (for deployment), Figure 01 in 2026 will likely be in pilots within automotive manufacturing. Their goal is to prove the business case for humanoids in logistics and assembly, focusing on integration with existing workflows.

- Apptronik – Apollo: Designed for logistics and manufacturing, Apollo in 2026 should be in wider commercial pilot programs (beyond initial partners like Mercedes-Benz). Their focus is on a practical, “hour-one useful” robot that is safe, durable, and serviceable.

- Agility Robotics – Digit: With its first factory “RoboFab” coming online, Agility’s 2026 will be about scaling production of Digit. Expect to see more DHL, Amazon, and other logistics partners testing fleets of Digits for trailer unloading and package movement.

- Chinese Companies (Fourier Intelligence, Unitree, Xiaomi): Expect extremely rapid progress. Companies like Unitree (famous for quadrupeds) will push the boundaries on affordable, capable humanoid platforms ($90k range). By 2026, they could be strong contenders in the global market, especially in manufacturing and research.

Key Technological Trends for 2026:

- 2026 robots will increasingly use large language models (LLMs) and vision-language-action (VLA) models for high-level task planning (“unload the dishwasher”) and natural language instruction. They will learn from video and simulation at an unprecedented scale.

- Hardware: Lighter, Stronger, Cheaper: Wider adoption of hydraulic-electric hybrids (like Tesla’s) for a balance of power and control. More use of composite materials and advanced actuators to reduce weight and improve energy efficiency.

- Tactile Sensing & Dexterity: Improving hands from simple grippers to more dexterous manipulators with basic tactile feedback, allowing handling of a wider variety of objects (tools, deformable packages, delicate items).

- Battery & Power Management: Incremental but crucial improvements in battery energy density and onboard power management to extend useful work cycles towards a full 8-hour shift.

- Simulation to Reality (Sim2Real): Massively accelerated training in hyper-realistic virtual environments will allow robots to gain thousands of hours of “experience” before trying tasks in the physical world, drastically speeding up deployment.

Probable Applications in 2026:

- Manufacturing & Logistics (The First Frontier): This is the primary market. Tasks will include machine tending, palletizing/de-palletizing, kitting, and moving boxes in warehouses and factories. The environment is semi-structured, and the economic case is easiest to make here.

- R&D & Academia: More affordable platforms (from Unitree, Fourier) will flood research labs, accelerating algorithm development for locomotion and manipulation.

- Early Stage of “Dull, Dirty, Dangerous” Jobs: Initial testing in environments like construction site material carrying or simple utility room inspections may begin.

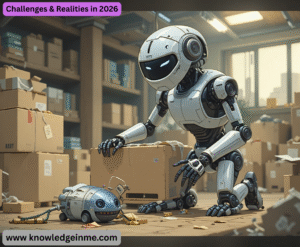

Challenges & Realities in 2026

- The Long Tail Problem: Robots will handle 80% of predefined tasks well, but the unpredictable 20% (a fallen object, a new type of box, an unusual configuration) remains a huge challenge.

- Safety & Certification: Deploying powerful mobile robots near humans requires rigorous safety certifications (like ISO standards), which is a slow process.

- Cost vs. ROI: Even at $50k-$100k, the total cost of ownership (integration, maintenance, programming) must clearly beat existing automation or human labor for specific tasks.

- Public Perception & Fear: High-profile deployments will trigger renewed debates about job displacement, safety, and the ethics of human-like machines.

The 2026 Tech Deep Dive: What’s Inside the Machine?

By 2026, the industry will have converged on a layered architecture:

- Layer 1: The “Spinal Cord” (Low-Level Control): Proprietary, real-time firmware for balancing, walking, and whole-body motion. This is the core IP of companies like Boston Dynamics and Agility. It runs on dedicated, low-latency processors.

- Layer 2: The “Cerebellum” (Mid-Level Execution): This layer sequences learned skills (e.g., “pick,” “place,” “open door,” “traverse stairs”). It’s a blend of classical robotics (motion planners) and small, efficient neural networks trained in simulation.

- A robot is given a natural language command (“Restock the supply cabinet with paper towels”). The LLM breaks it down into a task graph: Locate supply room -> Navigate to it -> Open door -> Find paper towels -> Pick up bundle -> Navigate to target cabinet -> Open door -> Place towels inside -> Close door.

- The Critical Glue: World Models: A 2026 differentiator will be the robot’s persistent, dynamic 3D map of its environment. It won’t just see objects; it will understand state (door is 40% open, box is full, drawer is closed). This “scene memory” is essential for long-horizon tasks.

The “Body” – Hardware Paradigms in Conflict:

- The Electric Actuator Race: Most companies (Tesla, Figure, Apptronik) use variations of rotary electric motors with high-ratio gearboxes (harmonic drives, cycloidal). The fight is over torque density (more power in less space/weight) and backdrivability (allowing force sensing and safe human interaction). Expect novel designs in 2026 like quasi-direct drives and liquid-cooled actuators to manage heat.

- The Hydraulic Edge (for performance): Boston Dynamics’ Atlas uses extremely high-pressure hydraulic actuators. This offers unparalleled power-to-weight and impulse (explosive movement). The trade-off is complexity, noise, and potential maintenance. For a pure performance lab bot, it’s still king. Will anyone commercialize this in 2026? Unlikely.

- The Materials Shift: Move beyond aluminum and steel. Carbon fiber composites for structural links (lighter, stiffer) and thermoplastic elastomers for soft, damage-resistant shelling are becoming standard. The goal is a robot that can survive a fall and is light enough for its own motors to handle.

The Global Race & Market Realities.

- The Silicon Valley Model (Tesla, Figure, 1X): “Move fast, leverage AI, iterate on data.” Their bet is that scaling software intelligence is harder than perfecting hardware. They prioritize fleet learning—where every robot’s experience improves the collective brain.

- The Traditional Robotics Model (Boston Dynamics, Agility): “Master the physics first, then add intelligence.” They have decades of embodied intelligence (locomotion, dynamics) and are now layering on AI for manipulation and task planning. They prioritize reliability and proven capability in chaotic physical environments.

- The Chinese Approach (Unitree, Fourier, LIMX): Blazing speed and aggressive cost engineering. They leverage a dense manufacturing ecosystem to produce capable hardware at 1/5th to 1/10th the cost of Western counterparts. By 2026, they could be the “Android phones” of humanoids—good enough for most R&D and targeted industrial applications, flooding the global market and putting immense price pressure on everyone.

- The “Hidden” Ecosystem: Companies like Sanctuary AI (focusing on general intelligence in a humanoid form, “Phoenix”) and Neurala (edge AI software) are critical players. Chipmakers (NVIDIA with Jetson/Isaac, Intel, Qualcomm) are battling to provide the optimized AI compute platform for the “robot brain.”